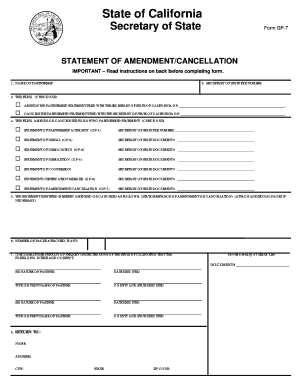

ONE). 5. THIS FILING AMENDS OR CANCELS ONE OR MORE PARTNERSHIP STATEMENTS: (CHECK. ONE) 6. THIS FILING AMENDS TWO OR MORE PARTNERSHIP STATEMENTS 7. THIS FILING AMENDS THREE OR MORE PARTNERSHIP STATEMENTS 8. THIS FILING AMENDS FOUR OR MORE PARTNERSHIP STATEMENTS 9. THIS FILING AND ANYONE (1) OF THE FIVE (5) FOLLOWING WILL COUNT AS ONE (1) PARTNERSHIP STATEMENT TO BE FILED. 10. THIS FILING AND ANYONE (1) OF THE FIVE (5) FOLLOWING WILL COUNT AS ONE (1) PARTNERSHIP STATEMENT TO BE FILED. 11. THIS WILL BE FILED IN THE NAME OF PARTNER NAME. 12. THIS WILL BE FILED WITH FORM GP-7 13. THIS STATEMENT IS IMPORTANT FOR THE FOLLOWING REASONS. 1. If the Form GP-7 is filed within one year after the last sale date, the statement is deemed a cancellation, and, if not filed within sixty (60) days of that date of sale, it is deemed abandoned. 2. The person or the assignee of a person is required to file with this statement a verified release for cancellation of sales. This is a condition precedent to the cancellation in California. 4) If any person sells or transfers ownership of a real property to another person and if that real property is located in California, this will be used to complete one of the following transactions. 5) If the real property is owned by a corporation or partnership, the shareholder will notify the corporation or partnership of the cancellation of the sale of the property. 6) If the real property is sold or transferred to a beneficiary, the beneficiary will notify the corporation or partnership of the cancellation of the sale or transfer of the property to the beneficiary. 7) If the real property is a partnership interest, the partnership will notify the corporation or partnership of the cancellation of the sale or transfer of the real property to the partnership. 8) If the real property is subject to a real estate taxes or use tax, a partnership will send a letter to the corporation or partnership stating that this sale is canceled. 3.

Get the free gp7 form

Show details

State of California Secretary of State Form GP-7 STATEMENT OF AMENDMENT/CANCELLATION IMPORTANT Read instructions on back before completing form. 1. NAME OF PARTNERSHIP 2. SECRETARY OF STATE FILE NUMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gp7 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gp7 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gp7 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gp 7 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill gp 7 form kenya pdf download : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sample filled gp7?

There is no specific definition for a "sample filled gp7" as it does not appear to be a widely recognized term or concept. It is possible that it could refer to a specific application or use of the GP7, which is a type of locomotive used in North America. Without further context or information, it is difficult to provide a more precise answer.

How to fill out sample filled gp7?

To fill out a sample filled GP7 form, follow these steps:

1. Start by providing your personal information at the top of the form. This includes your name, address, Social Insurance Number (SIN), and contact information.

2. Next, indicate the tax year for which you are completing the form. GP7 forms are typically used for previous tax years, so make sure to accurately enter the correct year.

3. In Section 1, entitled "General Information," provide details about your employment. This includes your employer's name and address, your occupation, and the start and end dates of your employment.

4. Section 2 is for declaring your income. List all sources of income you received during the tax year. This can include employment income, self-employment income, pension income, investment income, etc. Specify the income type and the amount earned for each category.

5. In Section 3, report any deductions or credits that you are eligible for. This can include deductions for employment expenses, union dues, child care expenses, etc. Provide the necessary details and amounts for each deduction or credit.

6. If you have any non-resident employment income or need to claim foreign tax credits, complete Section 4 accordingly. Provide details of the foreign income earned and any taxes paid in that country.

7. Section 5 requires information regarding any disability amounts or expenses you are claiming.

8. If you are eligible for any federal or provincial tax credits, complete Section 6 by providing the necessary details.

9. In Section 7, indicate if you have had any non-business income or capital gains during the tax year.

10. Review the form to ensure all information is accurate and complete. Make any necessary corrections or additions before submitting it.

Remember to consult the specific instructions and guidelines provided by your tax authority or seek professional assistance if needed.

What is the purpose of sample filled gp7?

A sample filled GP7 is a form typically used in medical documentation or medical research to gather information about a patient's health or medical condition. It is filled out by the healthcare provider or the researcher and includes various details such as the patient's demographic information, medical history, current symptoms, medications, and other relevant information. The purpose of the sample filled GP7 is to capture comprehensive and accurate data about the patient, which can be used for diagnosis, treatment planning, or research analysis.

What information must be reported on sample filled gp7?

The GP7 form is used to report an employee's record of earnings and deductions. The information that must be reported on a sample filled GP7 form includes:

1. Employee's name and social security number

2. Employee's address and contact information

3. Employer's name and address

4. Pay period start and end dates

5. Gross earnings for the pay period

6. Federal income tax withheld

7. Social Security tax withheld

8. Medicare tax withheld

9. State income tax withheld

10. Other deductions (such as retirement contributions or healthcare premiums)

11. Net pay (total amount paid to the employee after all deductions)

12. Date of payment

13. Employer's signature and date

It is important to note that the specific information required on the GP7 form may vary depending on local regulations and specific payroll systems in use.

How can I modify gp7 form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including gp 7 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit statement of amendment cancellation gp 7 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign sample filled gp7 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete download gp 7 form on an Android device?

Use the pdfFiller mobile app to complete your gp 7 form no download needed on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your gp7 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Amendment Cancellation Gp 7 is not the form you're looking for?Search for another form here.

Keywords relevant to g p 7 form kenya

Related to how to fill gp7 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.